If you are bullish on a given underlying, you probably think about buying a naked call. However, sometimes, the only option available to buy is a put. Should you buy it? Short answer: YES.

However, to replicate the call payoff, you actually need to delta hedge the put and then buy even more shares, to an amount equivalent to 100 delta... Which means that if you buy 1000 puts, then you buy 1000 shares.

To illustrate: If the call you wanted to buy initially has a 40 delta, then put at the same strike will have a 60 delta (put/call parity...) To equate the 40 delta of the call, then buy 40 delta more worth of shares... As simple as that.

Then, once the position is in place, if the the combination of put + shares will replicate a position on the naked call:

- when the underlying moves higher

- the put delta value will decrease, as well as the delta of the option (at a decreasing rate)

- the long shares position will gain in value

- when the underlying moves lower

- the put value will increase, as well as the delta

- the long shares position will lose money

The greeks profile in terms of gamma, theta and volatility will be the same.

Differences will arise if the option is american and there are dividends as the put is never exercised, while a deeply in the money call will be exercised before the dividend ex-date.

Below, using a Black Sholes pricer, comparison between the values of a 3month 50 naked call with a 50 spot price, volatility = 25% and an equivalent put, over-hedge (according to the description above) with respect to spot price changes.

And voila, under your eyes, you can see that we have a replicating portfolio.

Showing posts with label Implied Volatility. Show all posts

Showing posts with label Implied Volatility. Show all posts

Monday, 22 October 2012

Saturday, 8 September 2012

Steepness in the Forward Volatility Term Structure

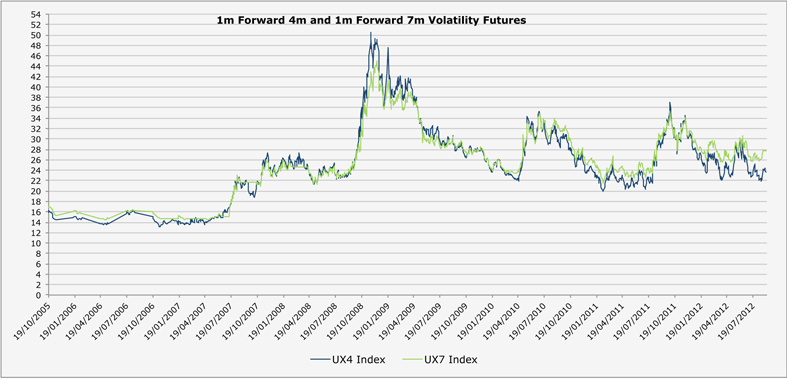

I was looking at the steepness in the forward implied volatility and found something interesting. Currently, in the wonderful VIX world, the 1 month forward volatility term structure is the steepest ever (99th percentile) over the last 7 years, when looking at the difference between the 7 month and 4 month forward contracts (UX7 Index and UX4 Index in Bloomberg). The difference is 4 vols.

The trade here, is to sell the 7 month and to buy the 4 month contract in order to benefit from the convergence between the two volatilities. So the position is paying decay. In order to figure out how much decay the position is inflicting, I had a look at the 1 month / 3 month contracts spread in order to assess the cost of carry. The difference is 5 vols, which means that, provided we hold the position until maturity, the cost of holding the spread is 1 vol.

Looking at the risk/reward, I believe that the maximum steepness between the two contracts will be 5 to 6 vols (losing 1 to 2), while the possible gain is of 4 to 6 vols. the risk/reward ratio seems appealing, while the cost of carrying the positing is one of the smallest since 2005.

Why is the forward term structure so steep?

I think that at the moment, we are in a world of financial repression where equity and bond markets are wherever central banks want them to be. The greater the level of monetary expansion, the calmer the VIX and the higher the gains in the S&P Index.

So, as realised volatility is poor and the equity market is rallying, implied volatilities are drifting lower and lower (even to truly absurd levels given the state of our economies), especially in the front end of the term structure. However, market participants still expect volatility to pick up in the future.

So in a certain way, we go back to the same question, which is how long our politicians and central bankers can kick the can down the road and avoid confronting the real issues.

Looking at the risk/reward, I believe that the maximum steepness between the two contracts will be 5 to 6 vols (losing 1 to 2), while the possible gain is of 4 to 6 vols. the risk/reward ratio seems appealing, while the cost of carrying the positing is one of the smallest since 2005.

Why is the forward term structure so steep?

I think that at the moment, we are in a world of financial repression where equity and bond markets are wherever central banks want them to be. The greater the level of monetary expansion, the calmer the VIX and the higher the gains in the S&P Index.

So, as realised volatility is poor and the equity market is rallying, implied volatilities are drifting lower and lower (even to truly absurd levels given the state of our economies), especially in the front end of the term structure. However, market participants still expect volatility to pick up in the future.

So in a certain way, we go back to the same question, which is how long our politicians and central bankers can kick the can down the road and avoid confronting the real issues.

Labels:

Derivatives,

Derivatives trading,

Forward Volatility,

Forward Volatility Term Structure,

Implied Volatility,

Tail Risk,

VIX,

Volatility trading

Monday, 3 September 2012

Bearish Trading Strategy - with a twist

If you are bearish on an underlying, on low

implied volatility names, you can:

- Buy a

naked put spread

- Buy a

put (hedged)

- Buy

an upside call (hedged)

Let's talk about the last trading strategy. It

sounds counterintuitive, however, let's have a closer look.

The interesting part is that, on a low implied

volatility / high convexity underlying, the return is higher than on a hedged

long put. See the detailed analysis below, for an instantaneous 5% down move.

Notes:

- As

the spot moves down by 5%, implied volatility follows the skew and is

readjusted. Lets imagine (and this is purely fictive) that implied volatility

moves up by 1% (fixed strike). Also, as we move away from our call, its implied

volatility increases more (convexity). So we considered that for the call, the

adjustment is 2 vols (This is an rough estimate - no science behind)

- Being

long the call, we end up with 9% delta, so we are still a bit short shares.

Being long the put creates a larger delta position, so we are more and more

long shares of a crashing underlying.

- The

highest performance is from the put spread strategy, we left it as a benchmark.

Labels:

Bearish Trading Strategy,

Convexity,

Derivatives,

Derivatives trading,

Implied Volatility,

Put Spread

Subscribe to:

Posts (Atom)