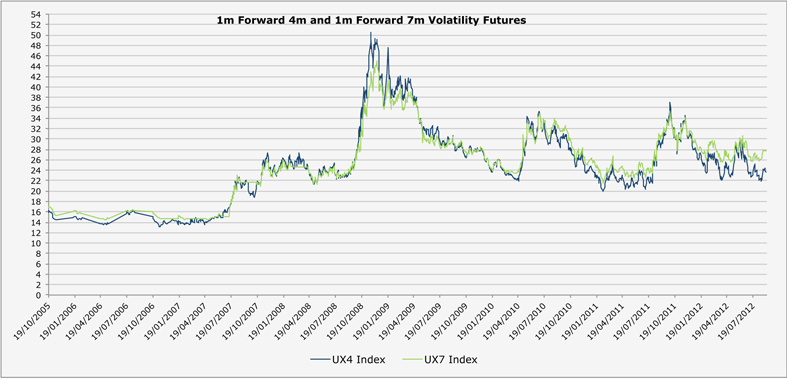

Looking at the risk/reward, I believe that the maximum steepness between the two contracts will be 5 to 6 vols (losing 1 to 2), while the possible gain is of 4 to 6 vols. the risk/reward ratio seems appealing, while the cost of carrying the positing is one of the smallest since 2005.

Why is the forward term structure so steep?

I think that at the moment, we are in a world of financial repression where equity and bond markets are wherever central banks want them to be. The greater the level of monetary expansion, the calmer the VIX and the higher the gains in the S&P Index.

So, as realised volatility is poor and the equity market is rallying, implied volatilities are drifting lower and lower (even to truly absurd levels given the state of our economies), especially in the front end of the term structure. However, market participants still expect volatility to pick up in the future.

So in a certain way, we go back to the same question, which is how long our politicians and central bankers can kick the can down the road and avoid confronting the real issues.

No comments:

Post a Comment