If you are bullish on a given underlying, you probably think about buying a naked call. However, sometimes, the only option available to buy is a put. Should you buy it? Short answer: YES.

However, to replicate the call payoff, you actually need to delta hedge the put and then buy even more shares, to an amount equivalent to 100 delta... Which means that if you buy 1000 puts, then you buy 1000 shares.

To illustrate: If the call you wanted to buy initially has a 40 delta, then put at the same strike will have a 60 delta (put/call parity...) To equate the 40 delta of the call, then buy 40 delta more worth of shares... As simple as that.

Then, once the position is in place, if the the combination of put + shares will replicate a position on the naked call:

- when the underlying moves higher

- the put delta value will decrease, as well as the delta of the option (at a decreasing rate)

- the long shares position will gain in value

- when the underlying moves lower

- the put value will increase, as well as the delta

- the long shares position will lose money

The greeks profile in terms of gamma, theta and volatility will be the same.

Differences will arise if the option is american and there are dividends as the put is never exercised, while a deeply in the money call will be exercised before the dividend ex-date.

Below, using a Black Sholes pricer, comparison between the values of a 3month 50 naked call with a 50 spot price, volatility = 25% and an equivalent put, over-hedge (according to the description above) with respect to spot price changes.

And voila, under your eyes, you can see that we have a replicating portfolio.

Showing posts with label Derivatives trading. Show all posts

Showing posts with label Derivatives trading. Show all posts

Monday, 22 October 2012

Saturday, 8 September 2012

Steepness in the Forward Volatility Term Structure

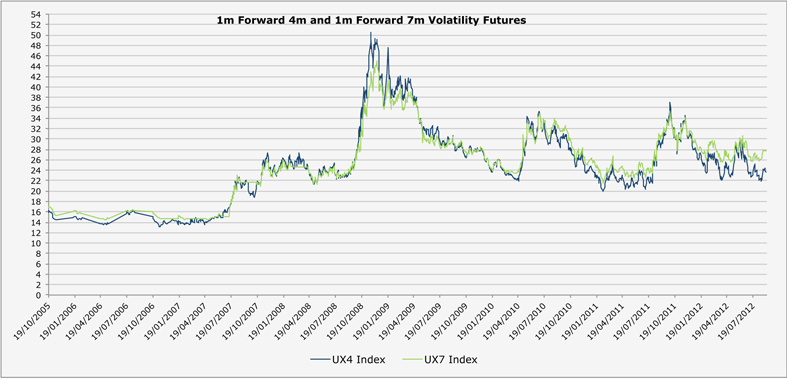

I was looking at the steepness in the forward implied volatility and found something interesting. Currently, in the wonderful VIX world, the 1 month forward volatility term structure is the steepest ever (99th percentile) over the last 7 years, when looking at the difference between the 7 month and 4 month forward contracts (UX7 Index and UX4 Index in Bloomberg). The difference is 4 vols.

The trade here, is to sell the 7 month and to buy the 4 month contract in order to benefit from the convergence between the two volatilities. So the position is paying decay. In order to figure out how much decay the position is inflicting, I had a look at the 1 month / 3 month contracts spread in order to assess the cost of carry. The difference is 5 vols, which means that, provided we hold the position until maturity, the cost of holding the spread is 1 vol.

Looking at the risk/reward, I believe that the maximum steepness between the two contracts will be 5 to 6 vols (losing 1 to 2), while the possible gain is of 4 to 6 vols. the risk/reward ratio seems appealing, while the cost of carrying the positing is one of the smallest since 2005.

Why is the forward term structure so steep?

I think that at the moment, we are in a world of financial repression where equity and bond markets are wherever central banks want them to be. The greater the level of monetary expansion, the calmer the VIX and the higher the gains in the S&P Index.

So, as realised volatility is poor and the equity market is rallying, implied volatilities are drifting lower and lower (even to truly absurd levels given the state of our economies), especially in the front end of the term structure. However, market participants still expect volatility to pick up in the future.

So in a certain way, we go back to the same question, which is how long our politicians and central bankers can kick the can down the road and avoid confronting the real issues.

Looking at the risk/reward, I believe that the maximum steepness between the two contracts will be 5 to 6 vols (losing 1 to 2), while the possible gain is of 4 to 6 vols. the risk/reward ratio seems appealing, while the cost of carrying the positing is one of the smallest since 2005.

Why is the forward term structure so steep?

I think that at the moment, we are in a world of financial repression where equity and bond markets are wherever central banks want them to be. The greater the level of monetary expansion, the calmer the VIX and the higher the gains in the S&P Index.

So, as realised volatility is poor and the equity market is rallying, implied volatilities are drifting lower and lower (even to truly absurd levels given the state of our economies), especially in the front end of the term structure. However, market participants still expect volatility to pick up in the future.

So in a certain way, we go back to the same question, which is how long our politicians and central bankers can kick the can down the road and avoid confronting the real issues.

Labels:

Derivatives,

Derivatives trading,

Forward Volatility,

Forward Volatility Term Structure,

Implied Volatility,

Tail Risk,

VIX,

Volatility trading

Monday, 3 September 2012

Bearish Trading Strategy - with a twist

If you are bearish on an underlying, on low

implied volatility names, you can:

- Buy a

naked put spread

- Buy a

put (hedged)

- Buy

an upside call (hedged)

Let's talk about the last trading strategy. It

sounds counterintuitive, however, let's have a closer look.

The interesting part is that, on a low implied

volatility / high convexity underlying, the return is higher than on a hedged

long put. See the detailed analysis below, for an instantaneous 5% down move.

Notes:

- As

the spot moves down by 5%, implied volatility follows the skew and is

readjusted. Lets imagine (and this is purely fictive) that implied volatility

moves up by 1% (fixed strike). Also, as we move away from our call, its implied

volatility increases more (convexity). So we considered that for the call, the

adjustment is 2 vols (This is an rough estimate - no science behind)

- Being

long the call, we end up with 9% delta, so we are still a bit short shares.

Being long the put creates a larger delta position, so we are more and more

long shares of a crashing underlying.

- The

highest performance is from the put spread strategy, we left it as a benchmark.

Labels:

Bearish Trading Strategy,

Convexity,

Derivatives,

Derivatives trading,

Implied Volatility,

Put Spread

Monday, 27 August 2012

Equity Volatility Skew

Equity Volatility Skew

Equity Volatility Skew, sometimes called strike skew, is the

measure of the disparity of option implied volatility for option contracts with

different strikes but the same expiration. It is the extrapolated tangent

between two given strikes implied volatility, and thus a slope.

In equities, most of

the time, it has a negative slope and is expressed by moneyness as the arithmetic

difference between implied volatility of the 90% put option and the implied volatility

of the 110% call option. It can also be expressed by strike (sticky strike, vol by

constant strikes) or by delta (sticky delta, vol by delta constant).

Skew and Black Scholes

Existence of Strike skew is

not predicted by the Black-Scholes model. Black Scholes model assumes that volatility

is a property of the underlying instrument, so the same implied volatility

value should be observed across

all options on the same instrument.

Equity volatility skew is a consequence of

empirical violations of the black Sholes stock prices return distribution

assumptions. Indeed, the Black-Scholes model assumes that stock prices are

lognormally distributed, which in turn implies that stock log-prices are

normally distributed.

Reasons for a Skew

Empirical: Market returns are more

leptokurtic than assumed in by the lognormal distribution. Market leptokurtosis

would make way out-of-the-money or way in-the-money options more expensive than

would be assumed by the Black-Scholes formulation. So by increasing prices for

such options (and thus implied volatility), existence of implied volatility

skew is a way of achieving higher prices than within the Black-Scholes model.

Statistical: Markets tend to fall

harder than they rise and skewness is a measure of the asymmetry of the distribution.

Being the 3rd standardized moment and representing this asymmetry, skewness

expresses in a certain way the observed correlation between the move of a random

process and its volatility (on this - to assess the risk neutral distribution

asymmetry implied by an option, a theoretical framework or model is needed)

Behavourial: Volatility skew could

reflect investors fear of market crashes, as deeply out of the money puts are a

form of insurance against market crashes. As they are considered as low cost in

terms of dollars, deeply out of the money puts are widely used as a protection

tools. Thus, skew can be seen as the perceived tail risk of the distribution of

the market and can be a valuable indicator that shows the market sentiment

toward a given underlying.

Structural Demand and Supply: The market

is ‘long stock’, so investors naturally tend to sell high strike calls options (to

enhance the yield of the portfolio through income) and to buy puts options in order to

protect the portfolio returns.

Use of the skew:

The first thing is that

there is not a single measure of equity volatility skew that is unambiguously best for all

purposes. In fact, skew is dependent from volatility level, maturity, spot

price. A very interesting way of expressing skew is (25 delta put volatility-25

delta call volatility) / 50 delta volatility, which emerges as the preferred

skew measure based on the theoretical and empirical analysis.

Predictive power of

returns: Academics tend to suggest that there is predictive

information content within the volatility skew, especially in the short-term

for stock market returns. However, market practitioners tend to make no money

from such findings. So it seems that there is no clear empirical relationship... Sorry guys.

There have been many attempts in the

academic literature to model the behavior of changes in skew, but the

interpretation of skew information by traders is still done largely on a

qualitative and ad hoc basis.

Trading

Skew

An experienced trader

explained me a rule of thumb, 10 delta difference between 2 options should

roughly equate to 1 vol difference. Skew will be expensive if above 1.5 and

cheap if below 0.5.

Risk Reversals, Put

Spreads and Call Spreads are skew trading strategies. The main drawbacks when

entering such king of strategy is that realisation of the skew will be impacted

by vol level and spot level, so a decent amount of noise will come affect the

trade. As the trade is done, moneyless/delta of the options is affected by the

spot and/or volatility changes and passage of time.

Also, when trading

short term options (less than 3m, for example) most of skew buying strategies

tend to have poor gamma/theta ratios. In other

words owning gamma via puts with high skews can be expensive in terms of theta

decay compared to a portfolio made up of at-the-money or call options.

Labels:

Derivatives,

Derivatives trading,

Equity Volatility Skew,

Skew,

Tail Risk,

Trading Skew,

Volatility,

Volatility trading

Wednesday, 15 August 2012

Game On (Tail risk in European Equities)

Today, I was wondering how much of tail risk is priced in the market at the moment. EURUSD currency pair provides one of the purest way of trading a potential Euro Zone breakup, while European stocks are my natural

underlying (because of my job).

Tail risk is cheap on a 5 year

relative basis in FX and damn cheap in equities.

- EURUSD: 6M 25D Butterfly:

Currently in 24th percentile on 5Y history

- Eurostoxx 50:

- 6M Put Skew (90%-100%)

currently in 9th percentile on 5Y history

- 6M Call Skew (100%-110%)

currently in 7th percentile on 5Y history

Most of the person I talk to

believe that the probability of a breakup of the euro through exit of Greece is non-negligible. Some of them even consider as pretty much already done. So I have a hard time reconciling the idea of a Euro break up (a true tail risk event, from my view) and low implied

volatility.

Indeed, it is not very clear how a

country can leave (or be forced to leave) the eurozone from a legal and

practical point of view. We have a very interesting paper which won the Wolfson

Prize on this topic, stating that ‘Overall, () analysis has revealed a series

of very tricky issues which any exiting country would need to face” “but all of

these difficulties can be overcome”.

In Summary, a country, such as

Greece, contemplating leaving the euro would have to keep its plans secret

until the last minute, introduce capital controls, start printing a new

currency only after formal exit, implement last-minute bank holidays, seek a

large depreciation (30/50%), default on its debts (note: redomination of debt

may not automatically lead to default as it depends on lex monetae and

contractual intentions, especially for countries that have issued debt under

domestic law), recapitalise bust banks and seek close co-operation with remaining

euro members.

“Such a rebalancing of the economy

away from reliance on net exports would be in the interests of the whole of the

current membership of the eurozone, as well as countries outside it,” according

to the paper. Nice.

Moreover, an exit also means heavy losses

for debt holders as debt is likely to be re-denominated in the depreciated new

currency. One-Off public costs of a euro area exit for European counterparts of

Greece (from The Economist) in Eur would be 323bn:

- Aid package 50bn

- Disbursements in bails

outs 127bn

- Govt bonds held by ECB 40bn

- Target2 debt 106bn

Talking about tail risk, I found an

interesting note by Bank of America-Merrill Lynch on game theory and euro breakup risk premium published

in July12. It explains that an uncooperative outcome dominates the strategies

of both Germany and Greece (this is why we are stuck for the last 2 years).

The paper also explains that in looking at output growth, borrowing cost,

balance sheet impacts, Italy and Ireland are the two countries benefiting most

from a voluntary exit of euro. Germany, despite being the most likely to leave,

has the lowest incentive to do so due to negative impact on growth and loss

from debt holding. So the game of Germany would be to ‘bribe’ Italy to stay.

However, the Nash equilibrium of

the game would be an exit of Italy regardless of what Germany does. This sounds

a bit extreme. However, I try to keep in mind that the world is much more

violent than what we would like to think and outcomes much more volatile than

predicted in our models.

So I do not understand why tail

risk is currently priced so low, if we consider the implications of a euro break up: sorting out the uncertainties and taking the losses.

The only thing I can think about is

QE and/or a weaker Euro… A recent survey of fund managers showed that 80% of

fund managers see ECB doing QE in Q3/Q4. So SX5E Call Spreads are really cheap

then?

References

http://www.economist.com/node/21560252

Labels:

Derivatives trading,

Equity Volatility Skew,

European Crisis,

Tail Risk,

Volatility,

Volatility trading

Tuesday, 14 August 2012

Bloomberg Functions For Equity

Equities Function

WEI World

Equity Indices

HVG Historical

Volatility Graph

HVT Historical

Volatility Table

HCP Historical

Daily changes and Volumes

HVP M Historical

Monthly changes and Volumes

HRH Historical

returns distribution

VAP Traded

prices + VWAP for a given intraday period

DES Company

Description

HDS Company’s

Owners

FA Company’s

Financial Analysis (BS, IS, CFS)

GV Historical

IV and RV Volatility (can chose % Moneyness for IV)

GIV Intraday

implied volatility changes (fixed strike)

OV Option

Pricing (includes payoff and Greeks graphs)

OSA Option

Portfolio (from OV)

OVDV Volatility

surfaces (much better than SKEW function)

OMON Option

Monitor, linked to the exchanges

MOSO Option

Most traded across markets

OMST Option

Most traded for a given underlying

OSCH Option

research tool

CT Contract

table (useful for Futures)

FH Futures

Hedge Ratio

BI Bloomberg

Industries (overview, detailed analysis of an industry)

RV Relative

Value tool (becomes powerful with customisation tools)

G Graph

GIP Intraday

Chart (can type GIP10)

GPC Long

Term Candle Chart

IGPV Graph

with technical studies

CIX Advanced

Graphing tool (spreads, ratios, etc)

HS Historical

Spreads with Statistical analysis

BTST Back

Testing of generic technical trading signals

READ Most

popular News

TOP Top

News

FIRS Bloomberg

First News

NI HOT Hot Headlines

NLRT Set

up News Alert

TNI Search

tool

CN Company

News

Monday, 13 August 2012

Let The Good Times Roll (European Equities and Credit)

The

relationship between stock price volatility and CDS spread is statistically

strong, with a historical correlation close to 0.70 in both regions.

Below, a

comparison of current Volatility and Credit levels

- Volatility is measured as V2X and VIX

- Credit is measured as Markit Itraxx Europe and USA Generic

5Y corporate CDS (basket of 125 cds for each)

Source: Bloomberg

Source: Bloomberg

Today, credit is in 80th percentile and 63rd percentile in Europe and USA, respectively while equity volatility is in the 52nd percentile and 34th percentile. In Europe, the spread is particularly large. This conflicting signal puzzles me, especially if I look at the following items (the list could be long):

-

Still potential breakup of the eurozone, with all the mess

it implies

-

ESM still not in

place and no clear support for a banking license that will allow the entity to

fund itself

-

ECB bond purchases seniority issue not resolved, pushing

private investors down the pecking order of creditors

-

Deterioration of corporate earnings and economic

indicators

From the

other hand, the spread between equity volatility and credit could remain at

high levels

-

The performance of equity markets is not that bad (+5.4%

so far in 2012), served by relatively better yields than in the rates market

and low valuation

-

The CDS index has 25% of financial companies against 22%

for the Equity index, explaining part of the difference

-

Also, CDS has underperformed vs Cash, due to the lack of

liquidity in the cash market and positive basis

As the

answer will come from our politics, so the catalysts to look at in September

are the following:

- 6th Sep : ECB Meeting :

SMP details?

-

12th Sep : Constitutional court of Karlsruhe for ESM vote

-

13th Sep: Fed meeting: QE3 or not QE3?

-

15th Sep : Euro Group meeting

What

history tells us:

From Luc

Laeven and Fabian Valencia, IMF : "An interesting pattern emerges: banking

crises tend to start in the second half of the year, with large September and

December effects."

From

Roggof, Harvard: crises to happen in election years. The intuition behind is

that crises are the result of imbalances that accumulate over a long time.

Politicians have a strong incentive to delay dealing with them until after an

election, and often, as was the case with Greece, to actually hide the truth

until the polls close. We had Elections in France, and US and China leadership

transition on the agenda.

Personally,

I tend to think that August will probably remain quiet.

However, I am really worried

about September 12, Equity

volatility should explode.

So let’s enjoy the end of the summer while it lasts.

Labels:

Credit,

Derivatives,

Derivatives trading,

European Crisis,

Volatility

Subscribe to:

Posts (Atom)